Want to Stop Being the IRS's Favorite ATM—LEGALLY and Without Risking an Audit?!

5 Day Event: LIVE April 7TH-11TH, @12-1 PM EST

"If You Filed Taxes Tomorrow, Would You Be Overpaying By Six Figures?"

WARNING: The IRS Has a Secret Plan for Your Money And Your CPA Doesn't Even Know About It!

WARNING: The IRS Has a Secret Plan for Your Money And Your CPA Doesn't Even Know About It!

"Your Business Could Be Leaking Thousands Every Month While Basic Tax Strategies Drain Your Profits Dry..."

If You Think Your "Standard Deductions" Are Enough, You're Dangerously Mistaken.

Your Current Tax Strategy Almost GUARANTEES Overpayment and IRS Enrichment.

Discover the Proven Strategy the Wealthy Use Instead to Protect Their Assets, Maximize Deductions, and Keep Every Dollar Possible Away From the IRS.

If You Think Your "Standard Deductions" Are Enough, You're Dangerously Mistaken.

Your Current Tax Strategy Almost GUARANTEES Overpayment and IRS Enrichment.

Discover the Proven Strategy the Wealthy Use Instead to Protect Their Assets, Maximize Deductions, and Keep Every Dollar Possible Away From the IRS.

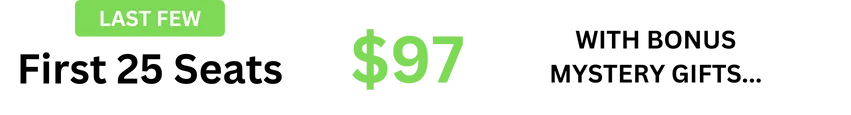

Join the Exclusive 5-Day "Stop Funding the IRS" Challenge Today—Just $250 $97!

Challenge Starts In:

⏳ URGENT: Limited Spots Available—Doors Closing Soon!

We are NOT your CPA, tax attorney, financial advisor, or fortune teller. We don't know your business structure, your revenue numbers, or your favorite tax loophole—so, naturally, we can't possibly be giving you personalized tax advice here.

This information is strictly for educational and entertainment purposes only. If you take action, your results depend entirely on you, your implementation, your business situation, and probably how organized your receipts are.

There's no magic wand here. Tax reduction takes real strategy and real decisions. And let's face it: most people procrastinate, complain, and stay stuck overpaying taxes forever. Don't be "most people."

When in doubt, consult a qualified tax professional, financial advisor, or psychic (though we wouldn't recommend the psychic—it's your money after all).

We are NOT your CPA, tax attorney, financial advisor, or fortune teller. We don't know your business structure, your revenue numbers, or your favorite tax loophole—so, naturally, we can't possibly be giving you personalized tax advice here.

This information is strictly for educational and entertainment purposes only. If you take action, your results depend entirely on you, your implementation, your business situation, and probably how organized your receipts are.

There's no magic wand here. Tax reduction takes real strategy and real decisions. And let's face it: most people procrastinate, complain, and stay stuck overpaying taxes forever. Don't be "most people."

When in doubt, consult a qualified tax professional, financial advisor, or psychic (though we wouldn't recommend the psychic—it's your money after all).

REALITY CHECK:

Every Single Day, Business Owners Just Like Yours Are Losing Hundreds of Thousands of Dollars—Because They Mistakenly Believe Their CPA Is "Handling Everything."

Here's the uncomfortable truth your accountant won't tell you:

Your Standard Deductions are a One-Way Ticket to Overpayment. You're leaving thousands on the table every single month—money that could be legally yours.

The IRS Takes the First Bite of Your Profits. Tens of thousands of your hard-earned dollars vanish into unnecessary taxes and missed deductions.

Your Business Faces Financial Drain at Every Turn. The moment you could be reinvesting in growth—your money is funding the IRS instead.

Do you really want to keep handing over six figures to the IRS when smart business owners are legally paying far less?

REALITY CHECK:

Every Single Day, Business Owners Just Like Yours Are Losing Hundreds of Thousands of Dollars—Because They Mistakenly Believe Their CPA Is "Handling Everything."

Here's the uncomfortable truth your accountant won't tell you:

Your Standard Deductions are a One-Way Ticket to Overpayment. You're leaving thousands on the table every single month—money that could be legally yours.

The IRS Takes the First Bite of Your Profits. Tens of thousands of your hard-earned dollars vanish into unnecessary taxes and missed deductions.

Your Business Faces Financial Drain at Every Turn. The moment you could be reinvesting in growth—your money is funding the IRS instead.

Do you really want to keep handing over six figures to the IRS when smart business owners are legally paying far less?

The Wealthy Know a Secret—And Now, You Can Too.

For generations, successful business owners have quietly used a simple, proven strategy to:

Slash their tax bill by $100K+ annually

Legally maximize every possible deduction

Protect every dollar of their profits from unnecessary taxation

And here's the best news:

No expensive tax attorneys needed

No complicated accounting systems

No risky tax schemes or gray areas

Imagine the peace of mind you'll have, knowing you're keeping every legal dollar possible—without fear of audits, without overpaying, and without funding the IRS's next party.

But You Must Act NOW—Before It's Too Late.

Stop Funding the IRS Challenge

"Reveals The 'Sneaky' Strategy Wealthy Business Owners Use to Slash Their Taxes, Annoy Their CPAs, and Keep Uncle Sam's Greedy Fingers OFF Their Money!"

Starts In:

Spots Are Limited. Doors Are Closing Soon.

In Just 5 Days, I'll Hand You the Most POWERFUL Tax Reduction Secret Ever Revealed...

'The Tax-Slashing Profit Shield'

—The Exact Step-by-Step Framework the Wealthy Quietly Use to Completely Minimize Their Tax Burden, Eliminate Costly Overpayments, and Instantly Keep More of Their Hard-Earned Money...

—The Exact Step-by-Step Framework the Wealthy Quietly Use to Completely Minimize Their Tax Burden, Eliminate Costly Overpayments, and Instantly Keep More of Their Hard-Earned Money...

...Then I'll Give You My Proven, Easy-to-Follow Process That Legally Maximizes Deductions, Guarantees You Keep Every Dollar Possible, and Ensures Your Business's Financial Efficiency—No Matter Your Industry.

...Then I'll Give You My Proven, Easy-to-Follow Process That Legally Maximizes Deductions, Guarantees You Keep Every Dollar Possible, and Ensures Your Business's Financial Efficiency—No Matter Your Industry.

No Risky Schemes. No Gray Areas. No IRS Red Flags.

Just Your Money Staying Where It Belongs—In Your Pocket.

WARNING: Read This BEFORE You Claim Your Spot!

Let's get brutally honest. This event isn't for everyone. In fact, there are some folks we absolutely do NOT want here.

Let's get brutally honest. This event isn't for everyone. In fact, there are some folks we absolutely do NOT want here.

This Event Is PERFECT For You If:

You're sick of watching 40%+ of your profits disappear to taxes, and you're determined to slam that door shut forever.

You genuinely care about growing your business wealth, and you're willing to take action to protect your profits from unnecessary taxation.

You believe your business deserves to keep every legal dollar possible—and you refuse to let the IRS take a single dime more than absolutely required.

You're smart, proactive, decisive, and ready to implement simple, proven strategies that wealthy business owners have quietly used for generations (but your CPA conveniently "forgot" to mention).

This Event Is Definitely NOT For You If:

You secretly enjoy funding the IRS's operations, and you think giving away half your profits is a fun annual tradition.

You believe "hoping" and "wishing" are foolproof tax planning strategies, and you're perfectly happy letting the government decide your financial future.

You're a chronic procrastinator looking for another excuse to avoid making important decisions for your business's future.

You refuse to take responsibility, prefer to blame others, or think someone else should magically handle your tax strategy for you.

Who the Heck is Dani—And Why Should You Trust Her With Your Tax Strategy?

Look, let me tell you something about Dani...

She's not your typical tax professional in a stuffy office. Actually, they've kind of become the "black sheep" of the accounting world. And traditional CPAs?

They absolutely hate her.

(But hey, that's what happens when you spend your career helping business owners keep their money OUT of the IRS's hands.)

Here's the deal: While most accountants are playing it safe with basic deductions, Dani and her team are doing something totally different.

They're showing business owners how to legally protect their profits from getting eaten alive by unnecessary taxes.

You know what's crazy? Dani has built this incredible team of tax strategists - we're talking seriously skilled people who've been doing this for almost 20 years.

Between them, they've got pretty much every financial certification you can think of. CPA, Tax Strategist, Business Advisor... the whole nine yards.

But here's what really matters...

For the past 20 years, they've been in the trenches, figuring out every legal way possible to help regular, hardworking business owners keep their money where it belongs - in their business's bank account.

Think about it this way: While most accountants are pushing the same old "standard deductions" advice, Dani and her team are actually showing business owners how to shield their assets from the tax man.

Let's be real - every single day, good businesses lose thousands to a system that's basically designed to take as much as possible. Dani and her team? They've made it their mission to stop that from happening.

So here's the bottom line: If you're serious about protecting your profits, Dani and her team are exactly who you want in your corner.

And if you're not? Well... there's probably an IRS agent out there already picking out their next office upgrade. With your money.

DAY 01

February 26th

12:00 - 1:30 PM EST

STOP BEING INVISIBLE:

How to Position Yourself as the ONLY Therapist Worth Paying!

What We Will Cover:

Why No One Knows You Exist—And How to Fix That Fast!

The Secret to Making People See You as the ONLY Logical Choice!

How to Craft an Offer So Irresistible, Clients Practically Beg to Work With You!

How to Stand Out in a Saturated Market (Even If Everyone Offers the ‘Same’ Thing)

How to Stand Out in a Saturated Market (Even If Everyone Offers the ‘Same’ Thing)

🎯 By the End of Day 1, You’ll Know EXACTLY How to Make Your Name Unignorable.

How to stand out from competitors—even in saturated markets.

🎯 By the End of Day 1, You’ll Know EXACTLY How to Make Your Name Unignorable.

DAY 02

February 27th

12:00 - 1:30 PM EST

RAISE YOUR PRICES

OR STAY BROKE:

The Art of Selling High-Ticket Therapy!

What We Will Cover:

Why Charging Higher Prices Attracts BETTER Clients (and Eliminates No-Shows)

How to Package Your Services Into Premium Offers That Clients Happily Pay For!

The Simple Confidence Hack to Charge More (Without Feeling ‘Salesy’ or Guilty)

How to confidently charge (and get) higher prices without resistance.

🎯 By the End of Day 2, You’ll Know How to Charge MORE and Attract Clients Who Actually Pay.

DAY 03

February 28th

12:00 - 1:30 PM EST

THE MONEY MULTIPLIER:

How to Attract & Close Multiple Clients at Once (Instead of 1:1 Calls)

What We Will Cover:

How to Run Group Presentations That Turn Strangers Into Paying Clients!

How One Company Used THIS Strategy to Go From $0 to $4B in 7 Years!

The ‘Silent Sales Machine’ That Pre-Sells Leads Before They Even Talk to You!

How to Get Your Clients to Pay for Your Marketing (And Be Excited About It!)

🎯 By the End of Day 3, You’ll Never Wonder Where to Find Clients Again.

How to get your clients to pay for your marketing & they'll be excited to do it!

🎯 By the End of Day 3, You’ll Never Wonder Where to Find Clients Again.

Here's EXACTLY What You'll Discover Inside the Exclusive 5-Day Stop Funding the IRS Challenge:

The 5-Day LIVE Event Breakdown: What to Expect

Day 1: "The Tax Strategy Wake-Up Call"

WARNING: 82% of Business Owners Make THIS Fatal Mistake—Guaranteeing They'll Overpay Tens of Thousands in Unnecessary Taxes.

The #1 DEADLY TAX MISTAKE that sends your hard-earned profits straight into the IRS's pocket (and how you can avoid it immediately).

Why your "standard deductions" are nothing more than profit leaks—exactly why they WON'T protect your wealth, and exactly what you MUST DO instead.

Shocking, real-life tax horror stories of businesses overpaying by $100K+ annually—and how you can easily avoid their costly fate.

Day 2: "The IRS's Plan vs. YOUR Plan—Who Do You Trust?"

FACT: If You Don't Have a Strategic Tax Plan, the IRS Already Has One For You—And You WON'T Like It.

The TWO tax planning options: YOUR strategy or the IRS's strategy. (Hint: You definitely DON'T want Uncle Sam deciding how much you keep.)

How standard tax practices instantly DRAIN your profits, FORCE you into overpayment, and WASTE tens of thousands in unnecessary taxes.

The hidden truth about business deductions—and exactly how YOU can legally maximize every possible write-off.

Day 3: "Basic vs. Strategic Tax Planning—The Hidden Truth!

REALITY CHECK: Your Standard Deductions Don't Avoid Overpayment—They Almost GUARANTEE It.

The shocking truth that traditional CPAs conveniently keep quiet: why basic tax planning actually guarantees overpayment—and exactly what you must do instead.

Exactly how Strategic Tax Planning keeps YOUR profits completely protected and OUT of IRS hands—guaranteeing you keep every legal dollar possible.

The THREE biggest misconceptions about advanced tax strategies—and why they're NOT just for mega-corporations. (You'll finally understand how these strategies can easily and affordably protect YOUR business, too.)

Day 4: The Power of Taking Control In 2025

QUESTION: What Happens When You Finally Start Playing by the Wealthy's Tax Rules? (The Answer Will Shock You.)

Exactly how Strategic Entity Structuring can instantly protect your profits—and why you must have this in place BEFORE tax season.

Real-life case study: Mike's incredible story—how his business legally reduced its tax burden by $127,000 using the exact strategies you'll learn here.

How to easily implement these critical protections NOW, before another tax season destroys your profits.

Day 5: Hidden Tax Strategy DANGERS—And How to Avoid Them

ALERT: 79% of Tax Reduction Plans FAIL—Sending More Money to the IRS. Here's EXACTLY How to Ensure Yours Actually Works.

The TOP 5 devastating mistakes business owners make with their tax planning—causing them to lose EVERYTHING. (You'll never make these mistakes after this session.)

Exactly WHY most tax reduction strategies fail to protect businesses—and exactly what you must do NOW to make sure YOUR strategy is rock-solid and audit-proof.

The common "IMPLEMENTATION" mistake that sends YOUR profits straight to the IRS—even when you have a solid plan. (We'll show you exactly how to avoid this costly mistake.)

"Spoiler Alert: The IRS Already Has Plans for Your Money"

⏳ They're Hoping You'll Keep Scrolling... (Don't Make Their Day)

Starts In:

Normal Price: $250 Special One-Time Price: ONLY $97

Imagine the peace of mind you'll have, knowing you're keeping every legal dollar possible—without fear of audits, without overpaying, and without funding the IRS's next party.

URGENT WARNING: URGENT WARNING: Your Business Profits Are Being Stolen...

From: Dani

Location: Arizona

Hey friend,

STOP EVERYTHING YOU'RE DOING AND READ THIS NOW.

Because at this very moment, the clock is ticking on a financial time bomb that's planted right under your business's future. And when it explodes – not if, but WHEN – it'll be too late to do anything about it.

DEVASTATING FACT: In the next 60 seconds, another unsuspecting business owner will OVERPAY their taxes by thousands. By the time you finish reading this letter, three more businesses will join them.

⚠️ THIS IS NOT A DRILL ⚠️

Your "standard deductions" – that basic tax strategy your CPA is using right now – is almost WORTHLESS against the sophisticated tax-saving techniques that wealthy business owners use every single day.

THINK ABOUT THIS:

- Your profits? DRAINED.

- Your deductions? MINIMAL.

- Your tax savings? NONEXISTENT.

- Your business's growth? STUNTED.

And here's the most terrifying part: This financial massacre is happening RIGHT NOW to businesses who think they're "doing everything right."

You have exactly TWO CHOICES:

1. Take immediate action (while you still can)

2. Join the growing list of businesses being financially DRAINED by excessive taxation

The clock is ticking... tick... tick... tick...

Every second you wait to address this is another second closer to catastrophe. And by then, it'll be TOO LATE.

Answer Honestly—Does This Sound Like You?

If tax season arrived tomorrow, are you 100% sure you're taking advantage of every legal deduction—without risking an audit?

If the IRS questioned your returns, would your tax strategy stand up to scrutiny while maximizing every possible saving?

If you answered "NO" or "I'm not sure" to ANY of these questions, then you're gambling with your business's financial future—and that's a gamble you cannot afford to lose.

The Good News: It’s NOT Too Late—Yet.

You can still take control TODAY. You can still protect your profits, your wealth, your business.

But make no mistake: This is your moment of decision.

You either ACT NOW and tax-proof your business's financial future—or you leave your profits vulnerable to unnecessary taxation.

⚠️ BUT READ THIS CAREFULLY:

This special event has strictly LIMITED SEATS. We're keeping this small and exclusive. Once it's filled—it's GONE.

⏳ DON'T RISK LOSING YOUR SPOT—REGISTER NOW.

Normal Price: $250 | Limited-Time Price: ONLY$97

The Question You MUST Ask Yourself Right Now…"

At this exact moment, you have a critical choice to make. And your business's entire financial future hangs in the balance.

Here's the single most important question you can ask yourself right now:

"Am I Really Willing to Risk Everything I've Built—My Business, My Profits, My Financial Freedom—By Leaving Them Exposed to Unnecessary Taxation?"

If your answer is "NO," then this exclusive 5-day challenge was created specifically for YOU.

Because here's what's at stake if you do nothing:

The IRS Could Take Half Your Profits—Leaving your business struggling financially when you could be reinvesting in growth.

You'll Keep Overpaying Year After Year—Your money gets drained, dollar-by-dollar, into unnecessary taxes and missed deductions.

Your Competition Will Leave You Behind—While they use these strategies to grow faster with their saved tax dollars.

Is THAT the Legacy You Want to Build?

But It Doesn’t Have to Be This Way…

Inside the 5-Day "Stop Funding the IRS" Challenge, you'll discover the exact tax-reduction blueprint wealthy, smart business owners quietly use to:

Completely minimize their tax burden—keeping their business profits protected and growing.

Legally maximize every possible deduction—keeping every possible penny in their business.

Instantly safeguard their assets—ensuring they never overpay a single dollar in unnecessary taxes.

Sleep soundly at night—knowing they've done EVERYTHING possible to protect their business's future.

Here's Exactly What Makes This Event So Different:

ZERO Complex Tax Jargon or Confusing Forms—Just clear, easy-to-follow steps any business owner can quickly implement.

REAL, Proven Strategies—Not theory. Not guesswork. Proven tax-reduction strategies real businesses are successfully using RIGHT NOW.

Immediate Action & Results—You'll leave each session crystal clear on exactly what to do next, with zero confusion.

Expert Guidance Every Step of the Way—Live Q&A sessions, personalized support, and a community of smart, committed business owners just like you.

"Seriously—Do You REALLY Want to Fund the IRS's Next Office Party?"

⏳ Seats Are Limited, and The IRS Is Hoping You'll Procrastinate. Don't Give Them That Satisfaction!

Starts In:

Regular Price: $250 | TODAY ONLY $97

"Still Skeptical? Good. You SHOULD Be."

Here's a dirty little secret most CPAs and tax professionals WON'T tell you:

They LOVE when you're skeptical, confused, and stuck doing nothing... because your indecision literally funds their basic, play-it-safe approach.

But don't take my word for it—listen to the smart, skeptical business owners just like YOU who decided to tax-proof their businesses and STOP overpaying:

"I was paying over $200K in taxes annually. After implementing these strategies, we legally reduced our tax burden by $127,000. My CPA never mentioned any of this!"

Michael R. Arizona

"As a 7-figure business owner, I thought I was doing everything right. This challenge opened my eyes to legal tax strategies I never knew existed. We saved $83K last year alone."

Sarah E. Virginia

"What a game-changer this has been! Finally, someone who speaks plain English about advanced tax strategy. We implemented just three strategies and saved over $95K."

A. Clarke

Do NOT Wait Another Second—Take Control NOW.

You can keep being skeptical, keep waiting, and keep overpaying... OR you can join these smart business owners and tax-proof your business TODAY.

✅ Save six figures in taxes

✅ Protect your hard-earned profits

✅ Stop funding unnecessary IRS parties

Act Fast—Make an IRS Agent Cry Today!

"How to Keep More of Your Money—Without Setting Off a Single Red Flag."

Challenge Starts In:

100% Money Back Guarantee

If, by the end of the challenge, your mind isn't blown with the legal tax-saving strategies revealed, I'll give you 100% of your money back. No questions asked. You'll get your money back, AND you keep all the bonuses. No catch. No risk. No excuses.

Join The challenge now

"A system that transforms tax burdens into profit opportunities."

Challenge Starts In:

Attend 'Stop Funding the IRS Challenge' Below!

🔒Secure Order Form

YES! Save My Spot For The 'Stop Funding the IRS Challenge'!

PRICE TODAY: $250 $97!

Use Code SAVE50

JOIN THE ' 30 APPOINTMENT CHALLENGE ' BELOW

🔒Secure Order Form

All 3 Days For Just : $97!

Your discount code is "SAVE50", use it before the timer below hits 0 to get 50% off...

Your discount code is "SAVE50", use it before the timer below hits 0 to get 50% off...

This site is not part of the Facebook website or Facebook Inc. Additionally, this site is NOT endorsed by Facebook in any way. FACEBOOK is a trademark of FACEBOOK, Inc.

Copyright 2025. All Rights Reserved.

REAL TALK (Disclaimer):

We are NOT your CPA, tax attorney, financial advisor, or fortune teller. We don't know your business structure, revenue numbers, or favorite accounting software—so, naturally, we can't possibly be giving you personalized tax advice here.

This information is strictly for educational and entertainment purposes only. If you take action, your results depend entirely on you, your implementation, your business situation, and probably how organized your receipts are.

There's no magic wand here. Tax reduction takes real strategy and real decisions. And let's face it: most people procrastinate, complain, and stay stuck overpaying taxes forever. Don't be "most people."

When in doubt, consult a qualified tax professional, financial advisor, or psychic (though we wouldn't recommend the psychic—it's your money after all)

There's no magic wand here. Probate-proofing your estate takes real effort and real decisions. And let's face it: most people procrastinate, complain, and stay stuck paying probate fees forever. Don't be "most people."

When in doubt, consult a qualified attorney, financial advisor, or psychic (though we wouldn't recommend the psychic—it's your money after all).